-

935-438-2799

935-438-2799

-

Become a Partner

Become a Partner

Become a Partner

Become a Partner

Wealth management is a consultative process and we cannot emphasize enough that one-size-DOES NOT-fit all! As you would experience, here at BullsVision™ we begin our interaction with a series of questions that you must answer, so that we could gauge the best possible ways in which your portfolio could be constructed - thereby helping you achieve the desired returns with the relevant risk classifications. Broadly speaking, every investor can be categorized in one of the following Risk classification:

For investors who are keen to generate income and look for stability in returns; rather than seek growth in capital.

For investors who seek to generate income and stability in returns; with modest potential for growth in capital.

For investors who are not dependent on the current income but are looking for growth in capital over long term; while there could be fluctuations in the returns, the allocation is less volatile compared to equity markets.

For investors who are seeking good growth potential over long term and not dependent on income as such; ability to see fluctuation in the allocation, albeit lesser than pure equity allocation.

For long term investors who are seeking substantial growth capital; one who understands equity markets or has previous experience and can with stand severe market fluctuations.

Once your risk assessment is established, our automated process will define a specific asset class recommendation that suits your requirements and a specific portfolio to further the investment process. Our team is continuously monitoring the recommendations that are given out and we periodically may alter the portfolio construction, basis several factors that influence such decisions.

Once we have been able to articulate the investor’s risk we are ready to make investment recommendations. These recommendations are made purely on the basis of the Current Financial Portfolio and the Risk Profile of the client. Our company policy does not allow us to form any bias on fund selection or the comprehensive wealth solutions that we offer. We act - and are expected to act - in the best interest of our client.The different products that we offer our guidance on are:

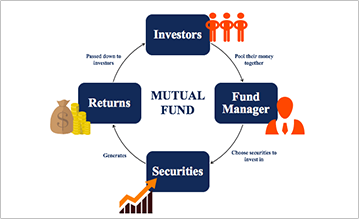

A Mutual Fund is a type of scheme which pools in money from many investors in order to purchase securities for a particular company. For the individual investor, a mutual fund is an extremely popular instrument, simply for the advantages it offers over other complex financial instruments. Currently there are over 9000 mutual fund schemes available through 45 asset management companies for subscription in the Indian mutual fund space, broadly under the various categories:

To ensure accuracy and professionalism in our research we have Certified Financial Planners in our core team members. We have devised a revolutionary tool, which helps to track large amounts of data and the behaviour of funds over its life cycle. Presented in an easy-to-read, easy-to-understand graphs and pie charts, the analysis helps point out proven investment strategies. With the help of this tool and trained professionals, BullsVision™ Fintech India Private Limited is able to conclude the best options in the market in the shortest possible time.

Direct Equity is one of the best avenues to fight inflation- Inflation drives up the cost of living and eats away the value of your savings. Traditional investment avenues like Fixed Deposits, Bonds, etc. have a limited upside of 8 to 10 %, whereas equities as an asset class have given an average annual return of about 13 % in the last 10 years. Hence, when it comes to beating inflation, equities are undoubtedly your best bet. Equity investments has helped a lot of investors in long term wealth creation. Investing in good businesses and growth stories at an early stage provides unlimited upside potential. For example, your investment of Rs. 1,000 in the Infosys IPO in 1993, would have fetched you Rs. 30 Lakhs today. Not participating in growth stories would certainly be an opportunity missed. Equities also provide you the flexibility of quickly changing your holding patterns to suit your requirements and also convert your holdings into cash instantly. This makes it the most suitable option compared to other asset classes for investors who are looking for liquidity

A fixed deposit (FD) is an investment option that allows you to invest a sum of money for a fixed time period and at a fixed rate of interest. During the tenure of holding a fixed deposit, even if the prevailing interest rates go up or down, the clients receive the pre-decided rate of interest. A corporate fixed deposit, as the name suggests, is offered by companies that are looking to raise money from the open market, with the prior approval of the market regulator. Corporate Fixed Deposits typically pay a higher rate of interest, but also carry a relatively higher risk than bank fixed deposits on account of credit quality. An investor should always inquire about the credit rating of a corporate fixed deposit before making a decision to invest in them.

Private Equity refers to equity capital invested in a private company through a negotiated process. Private Equity consists of investors and funds, which directly invest, in private companies. This form of Equity Capital is not quoted on the Public Stock Exchange; investing through this route allows investors to access unlisted companies which are potential leaders of tomorrow. The majority of private equity consists of institutional and accredited investors who can commit large sums of money for long periods of time. Potential profits are realized through various exit strategies including initial public offering (IPOs), trade sales, recapitalizations, etc.

A REIT is a company that owns and operates real estate investments with an intention to generate income. Theycan be privately or publicly held. They can also list themselves on the stock exchange. It is an interesting option for those investors who cannot afford to buy physical real estate for large sums yet can participate in the growth story through pre-decided participation. These investments are typically stretched over 6-8 years and hence a long-term horizon is important prior to making a decision to invest in these.

Structured investment products are pre-packaged investment strategies based on various underlying assets such as equities, interest rates, currencies, commodities etc. The value of the product can thus depend on the value of the underlying stocks or indices. The idea is to generate a particular payoff on the product to suit particular market views and maximize the returns thereof. Some structured products offer a 'principal protection' function if held to maturity. Typically in this, the buyer is aware of the investment strategy and goal before making the purchase. This is the structured part of the product, and it is this unique quality of these financial instruments that has led to increased investments in recent times. Structured products are complex in nature and many a time they have a minimum investment commitment and lock in period. Due to the above-mentioned reasons these products are more commonly sold to high net worth individuals.

The Portfolio Management Service (PMS) encompasses an investment portfolio in stocks, fixed income, debt, cash, structured products and other individual securities, managed by a professional money manager and can potentially be tailored to meet specific investment objectives. The investment philosophy is dependent on the fund manager though, with a large sum of money, the fund manager as well as the investor can take the investment decisions collectively.

AIFs offer a chance for our investors to go off the beaten track and invest in securities that are unavailable to the common investor. Real estate, venture capital, hedge funds, commodities, pre-IPO placements and derivative contracts can bolster the portfolio, mitigate risk and spur returns. While AIFs can also invest in listed equities, the structure allows for investments in securities which are unavailable under the traditional mutual fund platform.